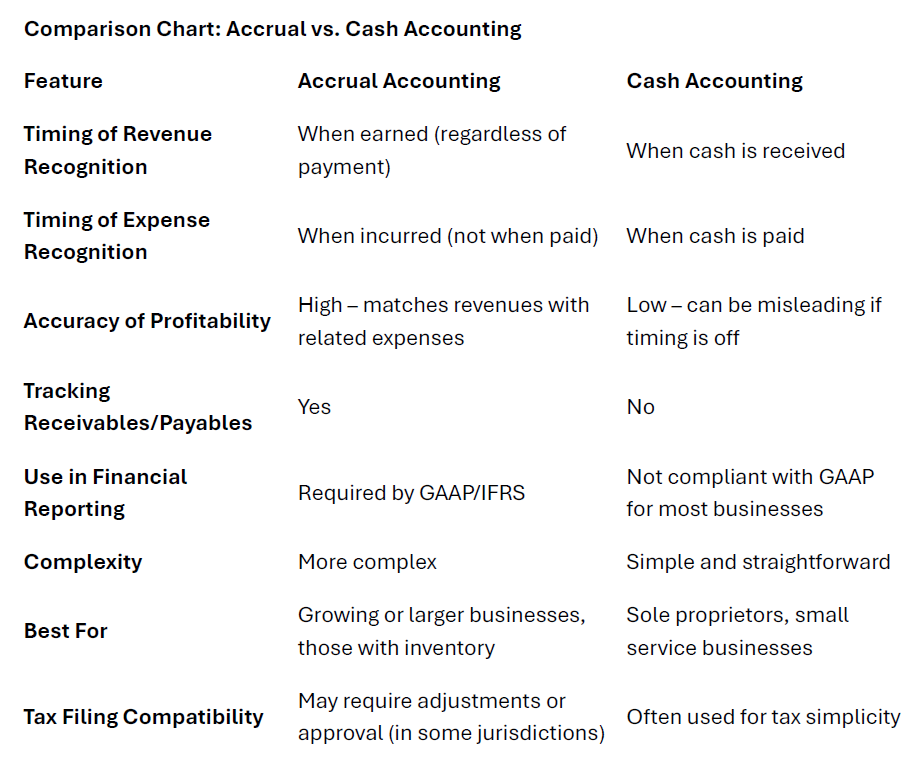

Comparing Cash vs Accrual Accounting

Here’s both a comparison chart and specific use cases where accrual accounting is strongly recommended:

Use Cases Where Accrual Accounting Is Strongly Recommended

1. Businesses with Inventory

If you sell physical products, GAAP typically requires accrual accounting to properly match cost of goods sold (COGS) with revenue.

2. Businesses with Credit Sales

If you invoice customers and receive payments later, accrual accounting captures income when it’s earned, not when it’s paid.

3. Growing or Medium-to-Large Enterprises

Accrual accounting gives a clearer picture of obligations, which is critical as businesses scale.

4. Companies Seeking External Financing or Investment

Lenders, banks, and investors usually require accrual-based financial statements to evaluate the financial health and risks of a business.

5. Contract-Based or Subscription Businesses

If you receive payment in advance or over time, accrual accounting helps recognize revenue across the contract period appropriately.

6. Businesses Subject to Audits or GAAP Compliance

Public companies, companies preparing for IPOs, or those under regulatory scrutiny need to use accrual accounting.

Need Assistance Determining The Best Accounting Method?

Contact LDG for small business consulting, accounting, and bookkeeping services. We are happy to answer your questions and assist you with moving your business in the right direction. Call or email us today to learn more about how our team can help.